The covid-19 pandemic and the resulting lockdowns led to panic buying in many countries across the globe. As Australia’s first quarantines were announced in March last year, chaos erupted at all sorts of supermarkets and bottle shops so that people could stock up on supplies.

A year into the pandemic, some areas of Australia are decreeing lockdown again, and, once more, panic buying is sweeping across grocery stores like a hurricane. Moreover, people are still allowed to leave home for essentials, and supermarkets stay open, as authorities continue to inform.

Our findings

SmartSpotter, through its crowdsourcing model and AI tools, has been researching current supermarket stock availability across Australia derived from lockdowns panic buying, as well as which stores have closed due to the pandemic. Thanks to our network of Spotters that help us collect data from all over the country, we have been able to understand and give a clear insight on which items are people purchasing and where are they panic buying.

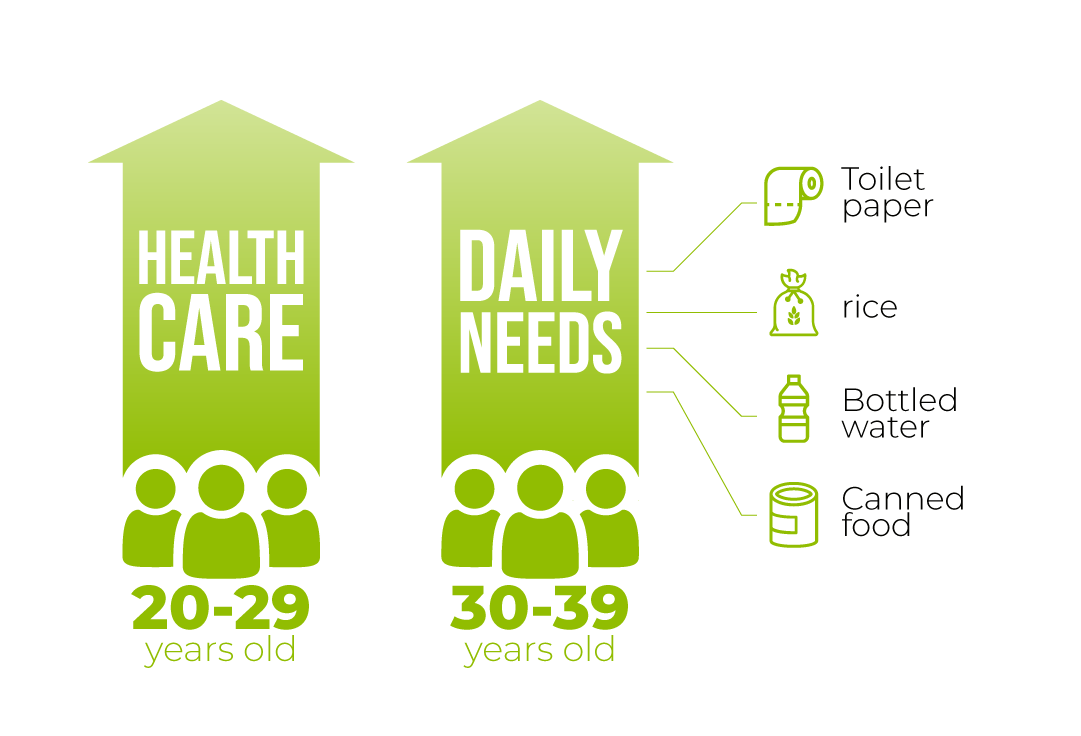

As to which group ages are more likely to report panic buying, research shows that 20-29 years old tend to buy more health care essentials, and 30-39 years old are more likely to stockpile daily needs, such as toilet paper, rice, bottled water and canned or prepacked food.

During the lockdown, the top growth driving food fixtures include meat, cereal, cheese, rice, oils, and pasta. As to non-food merchandise, there are medicinal products, cleaning goods, toilet paper, laundry, and dishwashing. This year, in times of panic buying, OSA for perishable products has improved, although items such as flour, pasta, cleaning tools and toilet paper persist in rapidly depleting.

FMCG Industry is adapting

As a result of the pandemic, consumers’ behaviours have changed, and so the FMCG industry responded and is still adapting. The economy is rebounding rapidly, and shoppers are in a positive headspace; data shows that consumer confidence is peaking. As a result, the retail industry grew by nearly 10% in the past year, which is almost five times faster than it increased the year before. However, as an answer to covid-19, both the way of buying and selling has shifted.

For example, Olive Oil companies have reported a spike in sales of bulk products (bigger sizes), so buyers minimize their visits to the stores. For liquor, most shoppers buy cases of Beer or Spititz rather than 6-packs, and the new packaging of 10-packs is a new trend.

E-commerce has also grown more vigorous in Australia, one of the highest growths across the globe. Our data also shows that Corporate Groceries and Independent stores that register more gains in lockdown times have a more extensive store network and better-located stores, as they are less exposed to reduced footfall.